The Ultimate Web2App UA Playbook for 2026: Scaling User Acquisition and ROAS

The rules for mobile user acquisition (UA) have been rewritten. In the wake of major platform privacy shifts and escalating competition, UA managers are actively seeking channels that offer predictable attribution, higher profitability, and better control. The new standard for scalable growth in 2026 is the Web2App funnel, especially within the subscription and direct-to-consumer (DTC) sectors.

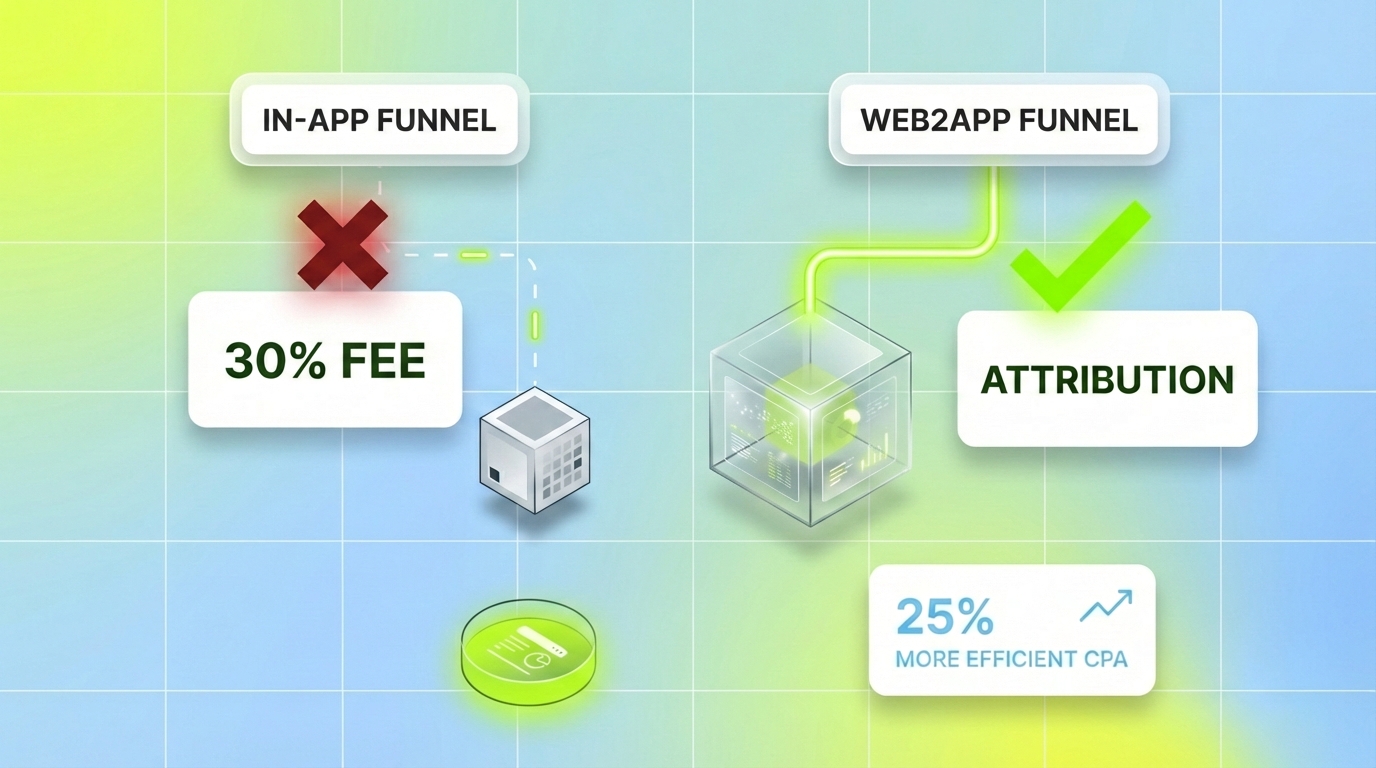

Web2App is no longer a niche strategy; it’s the primary growth engine for subscription, gaming, and DTC businesses. By moving the crucial conversion event, the checkout, onto a dedicated web property, performance marketers can bypass exorbitant platform fees and restore the deterministic data signals that are essential for efficient media buying. This shift unlocks the ability to scale your ad spend effectively and maximize your Return on Advertising Spend (ROAS).

For performance marketers, the mandate is clear: Master the Web2App funnel or face diminishing returns on traditional campaigns. This deep dive outlines the three core pillars of a high-performance Web2App strategy designed to succeed in 2026.

Key Takeaways (TL;DR)

Accelerated Market Growth: The Web2App industry is experiencing a rapid upward trend, with the number of funnels increasing by roughly 77% year-over-year

Superior Economics: Brands that successfully scale their Web2App funnels see approximately 176% year-over-year revenue growth and up to 25% more efficient CPA compared to traditional in-app acquisition channels

Conversion Multiplier: Web funnels convert new users to a first purchase roughly 2× better than standard in-app purchase flows (a median of 3% vs. 1.5%), thanks to superior control and personalization

LTV Maximization: Strategic implementation of one-click upsell flows can boost average Customer Lifetime Value (LTV) by as much as 20–30%

Creative Velocity is Mandatory: The total number of creatives used in Web2App campaigns grew by an average of 254% in Q3, signaling that continuous, data-driven creative testing is critical to feed platform optimization algorithms.

Pillar 1: Reclaiming Attribution and CPA Efficiency

The most immediate benefit of the Web2App model for UA managers is the ability to bypass the attribution decay and high commission rates associated with the app store ecosystems.

The Problem with In-App Purchase Flows

For subscription apps, every in-app purchase is subject to a mandatory 15% to 30% platform fee. Furthermore, in the post-ATT and Privacy Sandbox environment, the data signals available for optimizing ad campaigns that drive in-app purchases are severely limited. This combination drives down effective ROAS and limits the maximum viable Cost Per Acquisition (CPA) a UA team can sustain.

The Web2App Solution: Deterministic Data and Low Commissions

By driving ad traffic directly to a web-based landing page, the entire purchasing process is managed outside the app stores. This achieves two critical goals:

Lower Cost of Sale: Upfront subscription revenue is no longer subject to the App Store or Google Play commission, translating directly into higher margins and a more flexible CPA threshold.

Restored Attribution: Marketers can utilize standard web tracking tools, first-party data collection, and robust server-side integrations to accurately connect ad clicks to user behavior and revenue events. This deterministic data is crucial for feeding ad platform algorithms with high-quality signals, resulting in significantly improved optimization.

Analysis of high-performing Web2App brands shows that they are seeing CPA efficiency improve by an estimated 25% and achieving 176% annual revenue growth after adopting this model.

Geographic Segmentation: The US Market Advantage

Web2App is a global trend, but strategic UA planning must prioritize regions where the impact is highest. The U.S. is the clear leader, accounting for 55% of the total Web2App revenue worldwide.

However, conversion rates vary strongly by region, and it is crucial to test localized currencies and regional payment methods to maximize efficiency in markets outside the U.S. For instance, the median conversion rate (visit-to-purchase) is 3% globally, but can be higher in regions with better payment acceptance and local currency support.

Pillar 2: Hyper-Segmentation and High-Velocity Creative

Once the core economics are solved, the focus shifts entirely to the top-of-funnel conversion mechanics: creative messaging and tailored experiences.

The Multi-Funnel Imperative

A single, generic funnel is destined to underperform in a competitive environment. The most effective strategy involves launching multiple funnels, dozens, or even hundreds, each hyper-targeted to specific audience segments identified by demographics, pain points, or traffic source.

Leaders are no longer launching a single "Fitness App" funnel. Instead, they are deploying segments like:

"Home Pilates for Female Audience 40+"

"Keto Diet Plan for Busy Professionals"

"No-Equipment HIIT Workouts for Men"

This level of personalization, often built into the initial onboarding quiz, addresses the user’s exact need, significantly boosting motivation and conversion intent before the paywall.

The Creative Volume Crunch: An Average +254% Increase

The sheer volume of segmented funnels requires an equally massive scale of advertising creative to feed them. The algorithms driving platforms like Meta (especially after the Andromeda/Advantage+ updates) need a constant stream of fresh ad variations to optimize delivery and prevent creative fatigue.

Data confirms this escalating demand: The number of creatives launched to support Web2App funnels increased by an average of +254% in Q3 of a recent year. This isn't just about launching more ads; it’s about launching the right kind of ads that specifically target the narrow segments.

AI-Powered Creative Intelligence

Manually analyzing which specific creative elements (hooks, colors, music, CTAs) drive purchases in dozens of segmented funnels is impossible at this scale. This is where AI-powered creative intelligence becomes a competitive necessity.

Platforms like Segwise integrate performance data from all major ad networks (Meta, Google, TikTok, Snapchat, YouTube, AppLovin, Unity Ads, Mintegral, and IronSource) and MMPs (AppsFlyer, Adjust, Branch, and Singular) to create a Unified Creative Analytics Dashboard. The platform’s multimodal AI goes beyond basic tracking to automatically tag every creative asset, analyzing visual elements, spoken dialogue, on-screen text, and more. See How Segwise Uses Creative Tagging to Improve Ad Results

For UA managers, this intelligence enables you to:

Identify Winning Elements: See precisely which elements are driving your best ROAS and LTV from your segmented Web2App flows.

Maximize LTV with Creative: Understand the specific creative treatments that bring in higher LTV users.

Automated Fatigue Detection: Proprietary algorithms monitor asset performance decline in real-time, alerting you to fatigue before it critically impacts ROAS.

Competitor Intelligence: Track and analyze competitor creative strategies (currently Meta supported), apply the same AI tagging, and identify winning angles or oversaturated tactics.

Accelerate Production: Use data-backed recommendations to inform your creative briefs, cutting down time spent on ideation and improving creative win rates. The outcome is a faster test-and-scale cycle that saves your team up to 20 hours per week.

Pillar 3: Maximizing LTV and Recovering Lost Revenue

The final and most profitable aspect of Web2App UA is the ability to introduce powerful revenue maximization and recovery mechanics that are severely restricted in the native app store environment.

The LTV Multiplier: Post-Purchase Upsells

Once a user has completed the onboarding quiz and committed to a primary subscription, they are in the "buying mindset." This is the single most opportune moment to introduce a one-click upsell, which is far easier to implement and test on a web flow than within a highly regulated app store environment.

Upsells act as a powerful LTV multiplier, boosting overall revenue by an average of 20–30%. Best practice dictates that the upsell offer should be contextually relevant and, ideally, higher-priced when tied to a longer-duration primary subscription. This maximizes the average order value (AOV) without incurring additional acquisition cost.

Capturing Lost Revenue: Payment Recovery

Between 30% and 50% of all web payments fail due to soft declines (e.g., insufficient funds or expired cards). Unlike app stores, the Web2App model gives you the direct ability to recover this lost revenue.

The most effective recovery strategies include:

Intelligent Payment Retries: Using external billing solutions to automatically re-attempt failed payments with an optimized schedule. This can recover up to 17.5% of failed subscriptions and yields a 10–25% revenue uplift .

Fallback Scenarios: Route users on a failed payment screen to a dedicated flow that explains the problem and offers alternative payment methods (e.g., PayPal or a different card).

Subscription Retention Flow: For users attempting to cancel, implement a targeted flow (often via email/web pop-up) offering discounts (e.g., 50% off), a subscription pause, or a downgrade option. This can retain up to 80% of users who attempt to cancel.

Conclusion

The Web2App funnel is no longer an alternative strategy; it is the most crucial channel for sustainable and scalable user acquisition in the subscription economy. By offering superior data attribution, lower friction, and the ability to reclaim platform commissions, Web2App provides the necessary lever for UA teams to achieve and maintain their ROAS goals. The future belongs to marketers who embrace a strategy built on three pillars: hyper-segmentation to increase conversion, AI-driven creative velocity to maximize ad platform performance, and proactive revenue recovery to boost LTV.

If your UA team is ready to move past guesswork and deploy an AI-powered system that unifies cross-platform data, automatically tags your assets, and provides actionable insights on the creative elements that drive your highest LTV in your new Web2App flows, then it's time to act.

Frequently Asked Questions

Why is there a significant shift from in-app to Web2App user acquisition?

The shift is primarily driven by three factors: the high 15-30% platform commissions on in-app purchases, severe data limitations and attribution decay following privacy changes like Apple’s ATT, and the desire for greater control over the conversion flow. Web2App funnels solve these by lowering costs and restoring deterministic data signals for optimization.

How do Web2App funnels improve ad campaign performance and ROAS?

Web2App funnels restore deterministic tracking data that can be fed directly back into ad platforms like Meta and Google, allowing their algorithms to optimize much more effectively. This leads to approximately 25% improvement in Cost Per Acquisition (CPA) and significantly more efficient ad spend. The restored attribution visibility directly fuels ROAS efficiency and helps unlock scale.

Which categories are seeing the most rapid growth in Web2App adoption?

While Health & Fitness remains the biggest category, the fastest accelerating categories for new funnel launches are Finance & Career and AI Tools & Productivity. These verticals benefit most from quickly personalizing the user experience via web quizzes and capitalizing on the low-friction payment flows and greater LTV control provided by the model.

Is the increased creative volume in Web2App campaigns necessary for all UA teams?

Yes, high creative velocity (evidenced by a 254% growth in ad volume) is necessary for any UA team aiming for large-scale performance. Modern ad platforms require a constant supply of varied, segmented creative to maintain optimization. Without a high-volume testing strategy, creative fatigue will quickly set in, causing performance to tank.

What is the primary risk for companies scaling their Web2App payments

The main risk is payment account banning, particularly for fast-growing apps processing large volumes of subscription revenue. To mitigate this risk, businesses should prioritize integrating an external billing solution (Merchant of Record) to secure their data and reduce direct dependency on a single Payment Service Provider.

How can AI-powered creative analytics help with a multi-funnel Web2App strategy?

A multi-funnel approach generates too many data points for manual analysis. AI platforms like Segwise automate the entire process using multimodal AI to tag individual creative elements (hooks, colors, CTAs) and map them directly to performance metrics like ROAS and LTV. This provides actionable insights, drastically cuts down on manual data work, and enables data-backed creative iterations.

Comments

Your comment has been submitted