Key Mobile Gaming Statistics for 2025 and Beyond

Mobile gaming has become a massive market, with about $92 billion in revenue in 2024 and roughly 49% of global gaming revenue. Following the pandemic-driven boom, the market corrected in 2022–2023 and then stabilized, primarily in 2024. According to recent mobile gaming statistics, there are 3.2 billion active mobile gamers, a figure projected to rise to 3.5 billion by the end of 2025. Analysts expect the market to keep growing, with forecasts reaching $160 billion by 2030.

This guide covers key mobile gaming trends for 2025, including market size, player behavior, revenue patterns, and user acquisition tactics. It provides actionable insights for developers, marketers, and publishers seeking to optimize creative strategies, establish realistic KPIs, and plan for sustainable growth. All statistics cited in this guide are based on data from Udonis.

Global Mobile Gaming Market Overview

For mobile gaming marketing teams, these facts show where budget and creative effort matter most in 2025.

1. Market Size and Revenue

Mobile accounts for nearly half of the global game revenue, sitting inside a $187.7 billion global games market (mobile ≈ $92 billion). Console and PC revenues remain sizable, but smaller than those from mobile. Mobile keeps the largest share of industry revenue, so user acquisition and retention on mobile remain high-priority investments for marketers.

2. Regional Market Distribution

The Asia Pacific is the largest region by game revenue, at approximately $88.1 billion, although it experienced a slight decline year-over-year. North America grew to $50.6 billion (+1.7% YoY), and Europe reached $33.6 billion (+0.8% YoY).

Emerging markets are driving consumer-spend growth:

Turkey: +28%

Mexico: +21%

India: +17%

Thailand: +16%

Saudi Arabia: +14%

These markets are essential for scaling IAP campaigns and regional UA.

3. Growth Projections and Market Rhythm

Analysts expect the mobile games market to continue growing, with forecasts indicating a value of roughly $160 billion by 2030. After the 2022–2023 correction, the market stabilized in 2024, which supports steadier planning for spend and product roadmaps.

Market value shows only part of the story. To develop user acquisition strategies, you also need to know how often players download games and how engaged they stay after installs.

Downloads and User Engagement Statistics

Mobile gaming marketing teams need clear download and engagement signals to set UA and retention targets for 2025.

1. Download Trends

Global mobile game downloads were 49.6 billion in 2024, a 6% decline year-over-year as the market stabilizes and consolidates.

Top download markets in 2024 were India, the United States, Brazil, Indonesia, and China. Indonesia and Saudi Arabia were exceptions that showed download growth while many other markets slowed.

Lower overall download volume increases the value of efficient user acquisition and stronger retention. Growth markets like Indonesia and Saudi Arabia are worth exploring for their potential to drive lower-cost scale and increased engagement.

2. Genre Performance by Downloads

Simulation and Puzzle led downloads in 2024, each holding about 20% of total downloads (Simulation ≈ 9.8B, Puzzle ≈ 9.7B). Arcade was ~19% (≈ 9.6B).

Strategy downloads increased by ~14.5%, indicating growing player interest in mid-core experiences.

High-download genres offer a broad reach for UA creatives, while rising genres (such as strategy) indicate pockets where paid LTV can outperform install volume. Creative messaging and ad creatives should reflect the gameplay expectations of each genre to enhance the conversion from install to retention.

High download numbers don’t necessarily lead to high revenue. Analyzing monetization patterns reveals which markets and genres truly generate the best returns.

Revenue and Monetization Analysis

Revenue insights show which markets and genres deliver the highest return on acquisition:

1. Top Revenue Markets (IAP focus)

By in-app purchase (IAP) revenue in 2024, the leaders were: the United States $52B, China Mainland $25B, Japan $16B, South Korea $6B, and Germany $5B. The US remains the single biggest source of consumer spend.

Implication: campaigns that optimize for high-value US cohorts and prioritize LTV forecasting will often outperform broad, low-ARPU scale buys.

2. Revenue by Genre

Top revenue genres (IAP) in 2024 were Strategy ($17.5B), RPG ($16.8B), Puzzle ($12.2B), and Casino ($11.7B). Strategy and RPG are mid-core leaders in terms of spend.

3. Revenue vs. Downloads Paradox

Strategy games produced ~21.4% of total revenue while making up only ~4% of downloads. This large gap indicates that some small-install genres achieve outsized monetization, justifying higher UA bids per install.

Prioritize LTV models and cohort testing. Bids and creatives for high-ARPU genres can be set higher per install, while broad reach creatives can serve discovery for high-download casual titles.

4. Monetization Mix and Player Behavior

In-app purchases drive most spending: industry sources report that IAP and subscriptions have grown, and IAP remains the primary spending channel.

Ad behavior: 74% of US mobile gamers will watch a video ad for in-app content, and 82% prefer free games with ads over paid games without ads, supporting hybrid business models (IAP + rewarded ads).

ARPU (US): approximately $60.58 in 2025, with projected growth to around $65 by 2029, serves as a useful benchmark for LTV and bid planning.

Actionable note for teams: blend rewarded ads and IAP funnels to capture both non-paying users (ad revenue) and payers (IAP). Use ARPU targets to back into acceptable CPA and bid ranges for each market and genre.

Revenue trends become clearer when you understand the key players and their interactions with mobile games. Demographic and behavioral data help refine both targeting and creative strategy.

Mobile Gamer Demographics and Behavior

To plan user acquisition, retention, and monetization effectively, you need a clear understanding of who your players are, how they spend their time, and what keeps them engaged.

Who the Players Are:

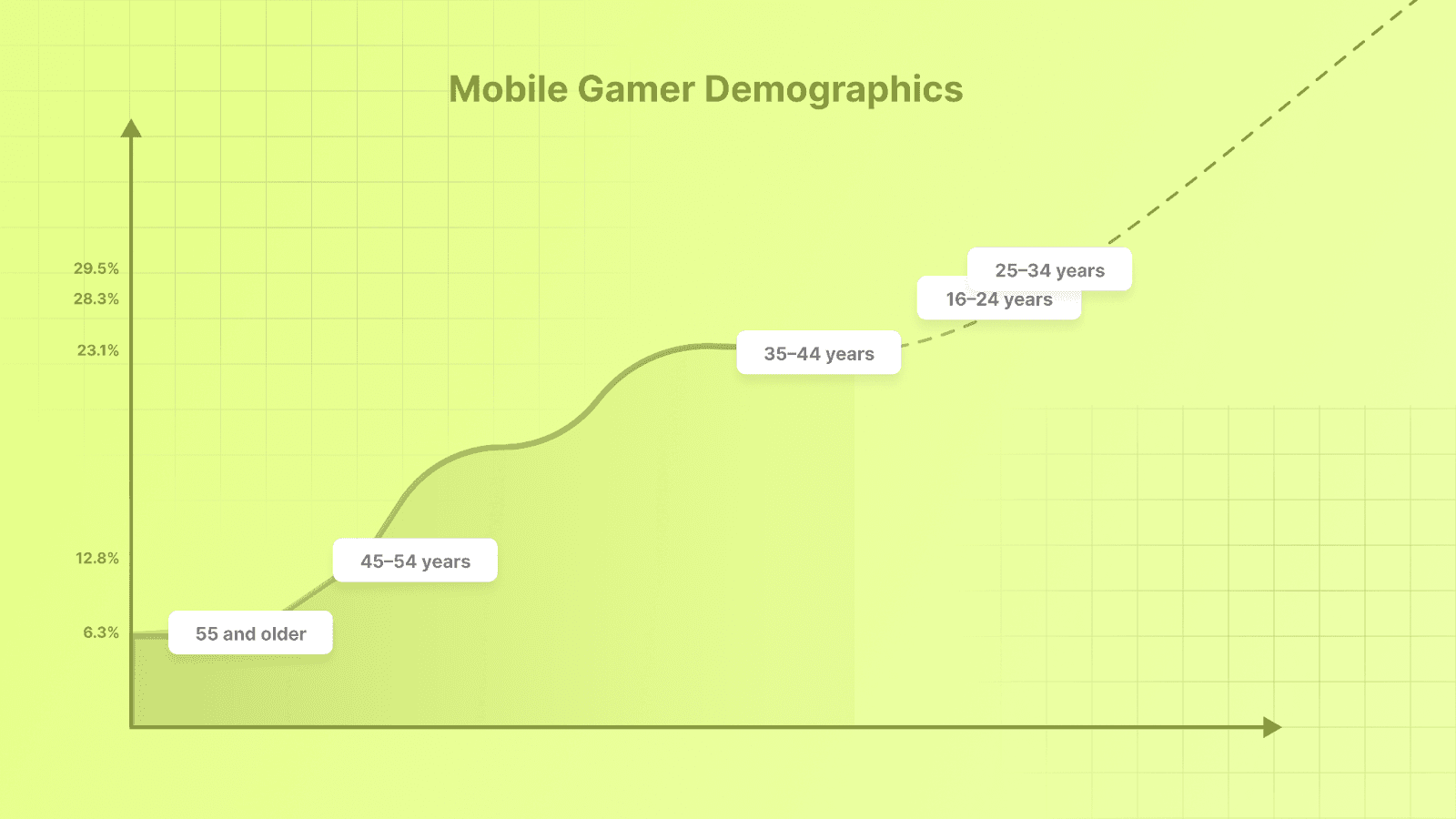

Mobile gamers today cover a wide range of ages, but the largest group is young adults:

16–24 years: 28.3%

25–34 years: 29.5%

35–44 years: 23.1%

45–54 years: 12.8%

55 and older: 6.3%

The average age is 36, with a nearly balanced gender split: 53.6% male and 46.4% female. This means your campaigns should appeal to both casual younger players and older groups with stronger spending power.

How Players Use Mobile Games

Engagement varies by genre, but some clear patterns stand out:

Average session length: 4–10 minutes

Daily playtime: 15–48 minutes

Sessions per day: 2–6

Casual players dip in and out, while mid-core and classic genres draw longer and more frequent sessions. These benchmarks can help you set expectations for session depth and retention in your own campaigns.

Generational Platform Preferences

Mobile dominates among younger audiences:

Gen Z: 77% play mainly on mobile

Millennials: 73% mobile-first

Gen X: 54% mobile

Baby Boomer: 34%

This confirms that mobile-first ad formats (short-form video, playable ads, rewarded ads) should be the focus when targeting younger cohorts. At the same time, older players may respond better to messaging that bridges across devices.

What Keeps Players Coming Back

Motivations include stress relief, passing the time, social interaction, and in-game rewards. After 30 days, players are most likely to return when:

They see new content updates

Friends share their progress or social invites

They receive return rewards or bonuses

Designing campaigns that highlight updates, social proof, and timed rewards will support both re-engagement and long-term retention.

While demographics provide a broad view of the audience, the top-performing games and publishers show what success looks like in practice.

Also read: Why Creative Tagging Matters for Mobile Game Marketers in 2025

Top Games and Publisher Performance

Understanding which games and publishers lead the market helps reveal where user interest and spending power are concentrated.

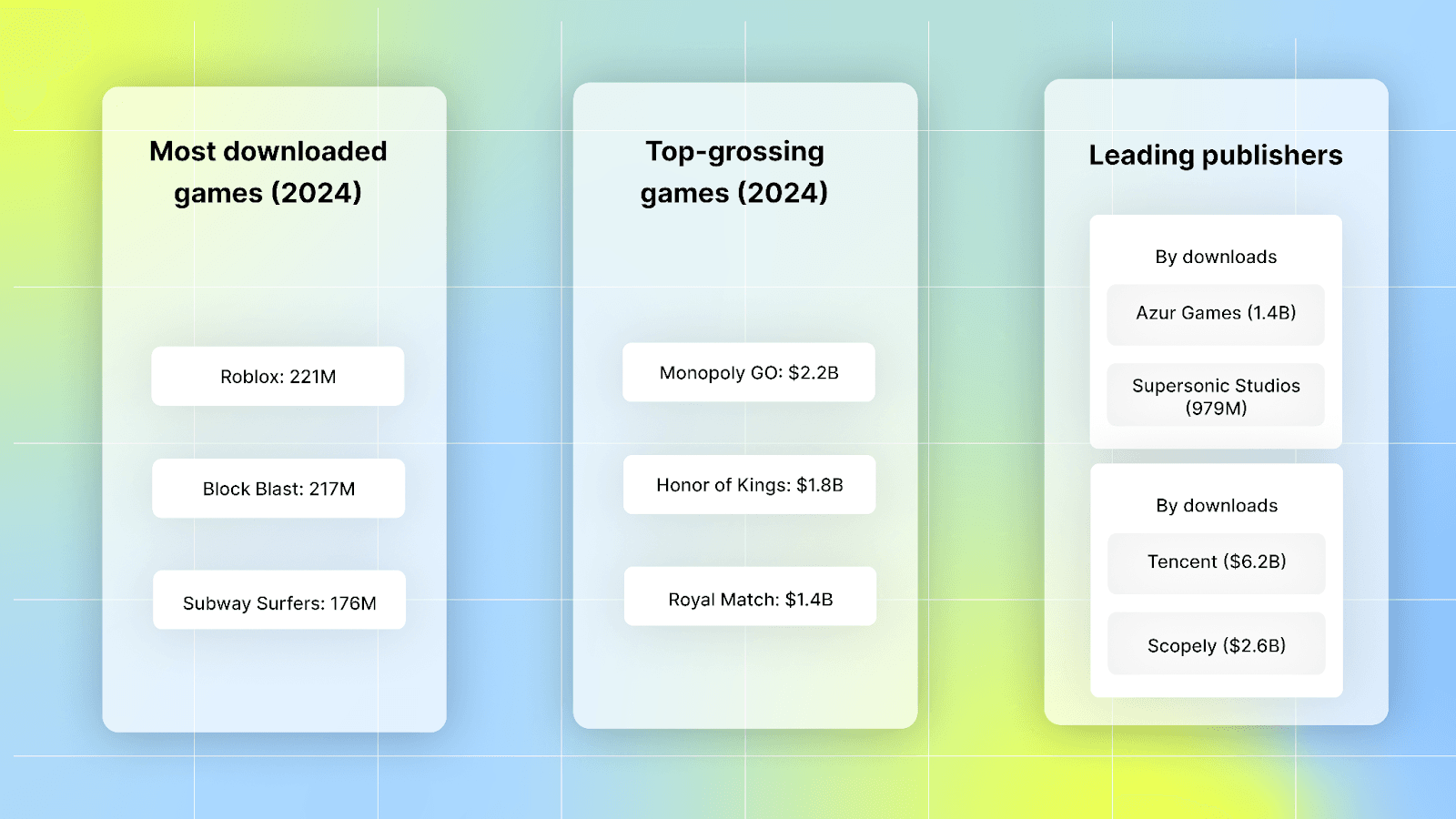

1. Most downloaded games (2024):

Roblox: 221M downloads

Block Blast: 217M

Subway Surfers: 176M

2. Top-grossing games (2024):

Monopoly GO: $2.2B

Honor of Kings: $1.8B

Royal Match: $1.4B

3. Leading publishers:

By downloads: Azur Games (1.4B), Supersonic Studios (979M)

By revenue: Tencent ($6.2B), Scopely ($2.6B)

These numbers show two sides of the market. Download leaders drive broad install volume, while revenue leaders highlight where high-value players spend. As a marketer, studying the creatives, live ops cadence, and monetization tactics of these top performers can provide direction for your own strategy.

But to stay ahead, you also need to understand how the advertising landscape and UA tactics are changing.

Marketing and User Acquisition Trends

For mobile gaming marketing teams, the ad market in 2024–25 changes how UA, creative production, and budget planning should be done. The numbers below show where to focus efforts and why.

1. Rapid Growth in Advertisers and Creatives

The number of mobile game advertisers surpassed 259,700 in 2024, marking a 60.4% year-over-year increase, and is expected to exceed 300,000 by 2025. Creative production also grew significantly: there were 46.2 million creative assets in 2024, representing a 15.4% increase from the prior year. These figures indicate that competition for attention is higher, making fresh creatives even more essential.

More advertisers and more creatives drive up noise. Marketing teams should prioritize faster creative testing, tighter KPI tracking, and clearer creative hooks to keep CPAs under control.

2. Platform Split and Creative Behavior

Most creative assets reside on Android, accounting for approximately 72.3% of total creatives, while iOS advertisers comprise less than 26% of the market. However, 70% of iOS advertisers launch new creatives each month, nearly 20% higher than Android. This suggests that iOS advertisers are fewer in number but operate at a faster creative pace. Video creative volume dropped (≈6.9%), while image creatives gained share among new monthly assets (≈+5.2%).

For campaign planning, Android offers scale for broad testing and volume buys. iOS offers a faster creative refresh cycle and often attracts higher-value users, so creative pipelines should be tailored to each platform rather than being one-size-fits-all.

3. Ad Spend Outlook and Format Trends

Global in-app ad spend is projected to reach about $390 billion by the end of 2025. Given the size of this market, video, playable, and rewarded formats remain crucial. Still, the recent drop in new video creatives suggests a subtle shift back toward high-performing image assets or shorter video cuts.

With ad budgets rising overall, higher bids and more aggressive scale are likely in top markets. Marketing teams should balance their spend between high-ARPU geos and lower-cost growth markets, while keeping a close eye on creative ROI and frequency caps.

What This Means Operationally

Creative ops: Build templates for rapid variants, prioritize image + short-form video hybrids, and automate A/B testing where possible. (Data shows monthly new creatives make up about half of all creatives on each platform.)

Channel mix: Use Android for broad reach and cost-efficient installs; use iOS for targeted, higher-LTV cohorts with a faster refresh cadence.

Budgeting: Expect rising competition in major markets; set ARPDAU/ARPU-based bid caps and shift toward geos with improving revenue trends when CPIs spike.

Creative format: Test image-first creatives alongside short video cuts and playables. Track creative fatigue closely, as the number of creatives and advertisers is growing rapidly.

These 2024–25 advertising and UA trends shape mobile gaming competition. Marketing teams should accelerate creative testing, optimize platform pipelines, and align bids to ARPU for sustainable growth. While broader trends are helpful, success relies on measurable goals, with genre-specific KPIs providing benchmarks for effective performance.

Also Read: Creative Optimization in 2025: Actionable Insights Report

Key Performance Indicators by Genre

These KPIs show what healthy games look like by genre. Marketing teams can use them to set realistic D1/D7/D28 goals, plan creative cadence, and choose channels.

1. Retention Metrics (Benchmarks)

Day 1 retention: top 25% performers

Day 28 retention: top 25% performers

Classic: ~5.5%

Casual: ~2.1%

Mid-core: ~1.6%.

How to use these figures: treat top-25% numbers as stretch targets and median figures as realistic starting points. For UA modeling, aim to keep D1 close to the top 25% of the genre for a given cohort that signals an initial product/creative fit, and track D28 to measure whether live ops and retention hooks are effective.

2. Engagement Metrics (Playtime, Sessions, Installs)

Average daily playtime (top 25% / median)

Classic: 48 min (top) / 31 min (median)

Mid-core: 34 min (top) / 17 min (median)

Casual: 28 min (top) / 15 min (median)

Average session length (top 25% / median)

Classic: 10 min / 6 min

Mid-core: 8 min / 5 min

Casual: 7 min / 4 min

Sessions per day (top 25% / median)

Classic: 6 / 4

Mid-core: 4 / 3

Casual: 5 / 3

Install ratio (first-time launches as % of DAU) — top 25%

Mid-core: 57%

Casual: 52%

Classic: 33%

Practical context for marketers:

High playtime and session length (classic, top mid-core) increase the likelihood of conversion via IAP or subscription. Bid and creative strategies should focus more on longer onboarding and deeper funnels.

Casual titles drive scale with more frequent, shorter sessions; creatives must focus on an instant hook and repeatability to lift D1.

Install ratio helps judge whether the ad creative attracts genuinely engaged users. A high install ratio (e.g., mid-core top 25%) indicates quality installs that are worth higher bids.

3. Benchmarks to Set In 2025

D1 target: aim for close to genre median → stretch to top-25% where CAC allows.

D7/D28: track drop from D1; if D28 falls below the median, prioritize onboarding fixes and incentive re-engagement.

Use playtime and sessions to choose ad format placement (rewarded ads are best suited for longer sessions; interstitials are ideal for short-session casuals).

KPIs set the targets for today. The next step is to look ahead at the trends and innovations that will shape mobile gaming and marketing strategies beyond 2025.

Also Read: Creative Analytics Explained: How To Track, Measure, And Improve Ad Performance

Emerging Trends and Future Outlook

These trends shape UA strategy, monetization, and product roadmaps through 2025 and beyond:

1. Major Market Trends (Clear Signals)

Cross-platform expansion: More titles are moving from mobile to PC/console to broaden their reach. This affects lifetime value and retention planning.

Privacy adaptation: Ad and UA strategies are changing to comply with new privacy rules; first-party data and creative testing matter more than ever.

Hybrid monetization: Combining IAP, ads, and subscriptions is now common. Reliance on a single method is shrinking.

Hybrid casual replacing hyper-casual: Games that mix easy accessibility with deeper hooks are gaining engagement and retention advantages.

2. Technological Shifts to Watch

In-app bidding dominance: Programmatic in-app bidding has replaced old waterfall setups for ad monetization, changing eCPM dynamics and yield strategies.

Better targeting & UA tactics: Innovative marketing and improved UA approaches are becoming essential in the new privacy environment (more tests, content-first creative strategies).

3. Market Predictions and Scale

Store saturation: With over 700,000 mobile games across Google Play and Apple’s App Store, competition for installs is fierce.

Emerging market growth: Emerging markets (Turkey, Mexico, India, Thailand, Saudi Arabia) are fueling revenue and should stay part of expansion plans.

Player preferences will shift: Players are moving toward games that reward time and social interaction, and they favor hybrid monetization and frequent content drops.

For marketing teams, these KPIs and trends create a clear playbook: set genre-specific retention and engagement targets, match creative and channel strategy to session patterns, and lean into hybrid monetization and privacy-aware UA methods to win in 2025.

Also Read: Top Creative Analytics Tools for Successful Ad Campaigns 2025

Conclusion

Mobile gaming marketing teams should focus on a short list of practical moves: set clear genre-specific KPIs, tighten creative testing and tagging workflows, and align monetization to player life cycles. These steps turn the trends and KPIs in the post into measurable priorities for campaign planning and budget decisions.

Segwise automates creative tagging across images, video, and playable ads using AI agents that label hooks, characters, visuals, and audio. It connects those tags to performance metrics (ROAS, CPI, CTR) and surfaces tag-level analytics so teams can see which creative elements correlate with results. Through no-code integrations, Segwise unifies ad-network and MMP data into customizable dashboards and reports.

Start your 14-day free trial today. No credit card or engineering required.

FAQs

1. How do you pick the right LTV window for measuring campaign performance?

Start by comparing cohort curves at 30, 60, and 90 days; pick the earliest window that reliably correlates with long-term revenue for your genre. Use the window that best predicts payback/ROAS for cohorts used in scaling decisions. Validate with holdback experiments (keep a small test cohort unscaled and compare full-year outcomes).

2. How can you effectively localize creatives for new markets without a large team?

Build modular ads (replace text/voice/UI overlays without redoing assets), run small A/B tests with local testers or quick market samples, and scale only the variants that improve installs + early retention. Automate tagging to identify which localized elements actually impact metrics before a broad roll-out.

3. What steps can you take to spot and reduce ad fraud in UA campaigns?

Use a reputable MMP, along with a fraud-detection layer, to monitor anomalies (such as spikes in install volume, extremely low click-to-install times, unusually high CTRs, or short session lengths). Set automated rules to quarantine suspicious publishers/geos. Combine real-time blocking with post-attribution audits and maintain a blacklist of bad sources. External fraud partners (or MMP fraud suites) are standard practice.

4. When is influencer marketing more useful than paid user acquisition?

Use influencers for discovery, community-building, and activation around soft launches or live ops. They’re best when you need social proof or organic momentum. Use paid UA when you need predictable scale, clear attribution, and fast experimentation. Combine both: run influencer tests, turn top creatives into paid assets, and measure incremental installs/retention.

5. How do you design price and offer tests that actually grow revenue?

Run randomized A/B or holdout tests on offers (bundles, first-time purchase, time-limited packs), compare net revenue per user and retention across matched cohorts, and only roll out changes that show statistically significant, persistent uplift. Use control groups to measure incremental ARPU and check payback windows against your LTV/CAC target.

Comments

Your comment has been submitted